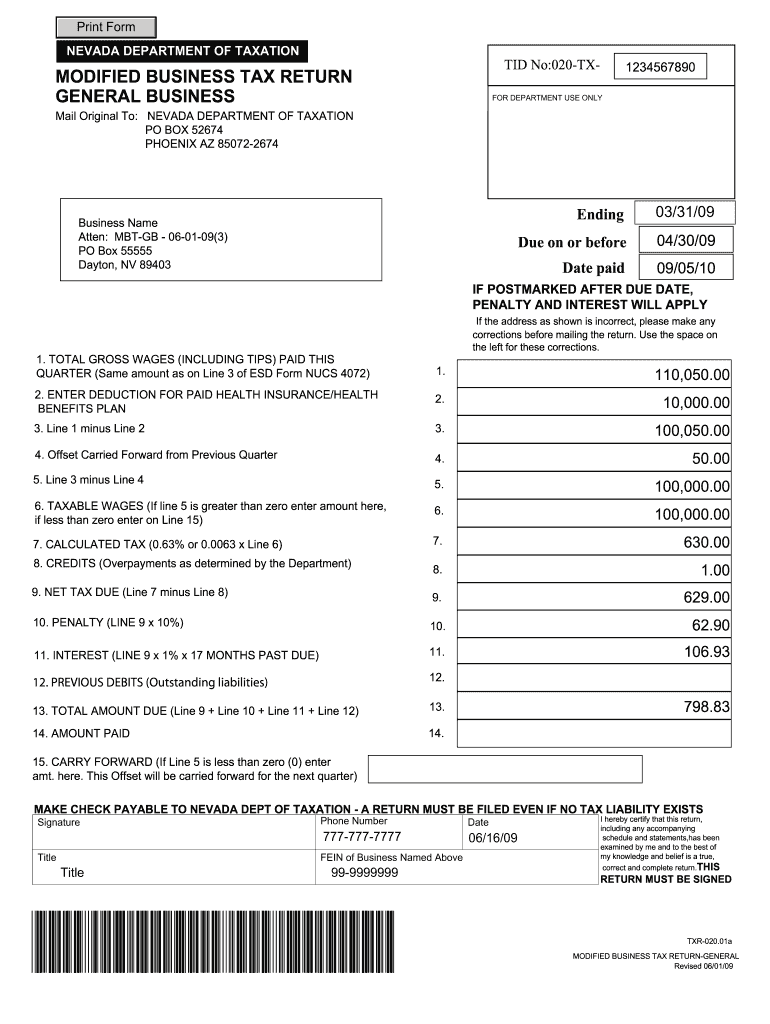

modified business tax nevada due date

The due dates are April 30 July 31 October 31 and January 31. If payment of the tax is late penalty and interest as calculated below are applicable.

Aluminum In Drinking Water Guideline Technical Document For Consultation Canada Ca

Businesses or individuals may pay its delinquent tax online using a credit card or debit.

. This typically happens in April July October and especially January which coincides with the due dates of monthly quarterly and sometimes annual returns. San francisco ca 94120-7165. Ad TurboTax Offers Industry-Specific Tax Solutions So You Uncover Every Business Deduction.

The result is the amount of penalty that should be entered. The 31st Special Session of the Nevada Legislature enacted Senate Bill 3 which provides for a one-time tax amnesty program for businesses or individuals doing business in Nevada who may have an existing tax liability. 1-866-457-6789Send an e-mail to taxfraudstatenmus Download the Fraud Information Report Form mail or fax it toNew Mexico Taxation and.

For additional questions about the Nevada Modified Business Tax. 12 rows Due Date Extended Due Date. If the credit amount is higher than the MBT tax owed it may be carried forward up to the fourth quarter immediately.

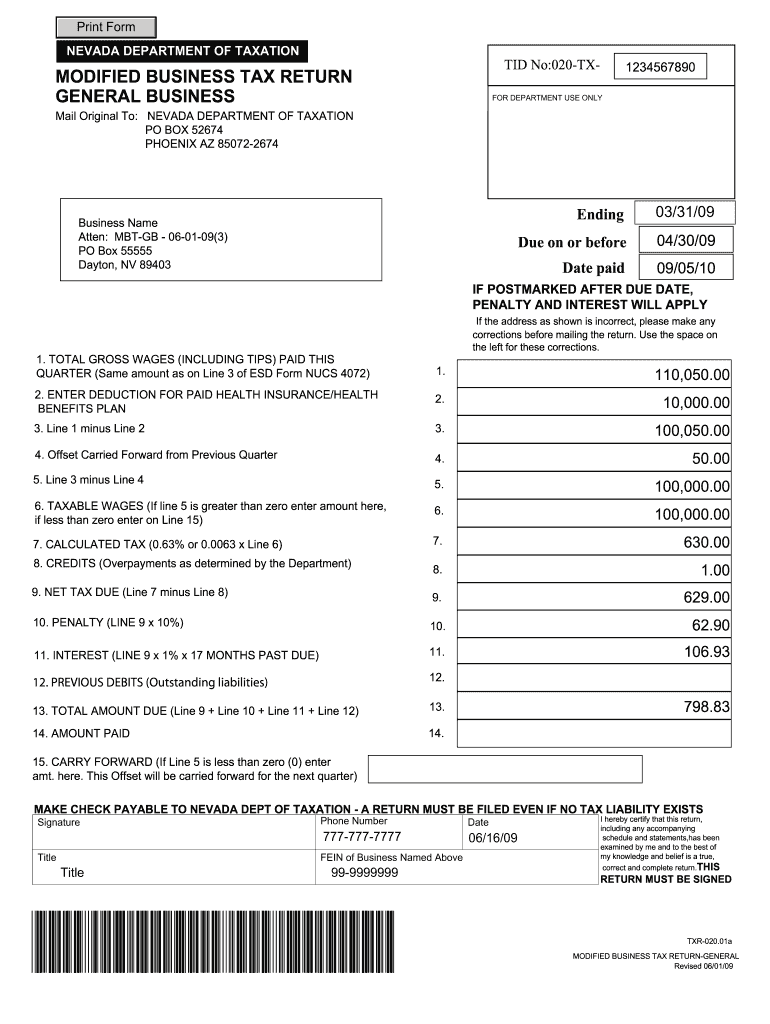

SALT Report 3089 The Nevada Department of Taxation is advising taxpayers that the September 30 2013 modified business tax returns were printed with the old 62500 threshold for Tier 1 rather than the correct 85000 threshold which became effective on July 1 2013. If postmarked after due date penalty and. Nevada department of taxation modified business tax return.

Taxpayers should download a corrected version of the form to ensure proper reporting. Q1 Jan - Mar April 30. Do not enter an amount less than zero.

All forms and tax payments are due by the end of the month following the end of the four-month period. Line 6 Taxable wages is the amount that will be used in the calculation of the tax If line 5 is greater than zero this is the taxable wages If line 5 is lessLINE 10- If this return is not submittedpostmarked and taxes are not paid on or before the due date as shown on the face of this return the amount of penaltyLine 11 Interest - If this. General business effective july 1 2015 for department use only.

Nevada Business Tax Extension. If postmarked after due date penalty and. The collection of bond contributions began with the first quarter 2014 with a due date of April 30 2014 and will continue to be collected quarterly from employers until the bonds are fully repaid in late 2017 or early 2018.

Prior to July 1 2015 SB475 of the 2013 Legislative Session amended the tax rate to 117 on taxable wages over 85000 and prior to July 1 2011 AB561 amended the tax rate 117 on taxable wages over 62500. Try to edit your document like signing highlighting and other tools in the top. 021-TX-IF POSTMARKED AFTER DUE DATE PENALTY AND INTEREST WILL APPLY If the address as shown is incorrect please make any corrections.

For additional questions about the Nevada Modified Business Tax see the following page from the State of Nevadas Department of Taxation. The number of days late is 15 so the penalty is 4. San francisco ca 94120-7165.

Nevada department of taxation modified business tax return. Keep Every Dollar You Deserve When You File Business Taxes w TurboTax Self-Employed. Penalty - If this return will not be submittedpostmarked and the taxes paid on or before the.

Due to increased returns and payments received processing can take longer than normal. When Are the Forms and Tax Payments Due. Forms and payments have to be mailed or hand delivered to one of the four district offices of the Nevada Department of Taxation.

Follow these steps to get your Modified business tax return nevada edited with accuracy and agility. Q2 Apr - Jun July 31. There are no changes to the Commerce Tax credit.

This amount is due and payable by the due date which is the last day of the month following the applicable quarter. If the due date falls on a weekend the Commerce Tax is due the. Nevada Department of Taxation PO Box 7165 San Francisco CA 94120-7165.

A tax return will still need to be filed by all employers even if the taxable wages are less than 50000 and tax due is 0. For example if the taxes were due January 31 but not paid until February 15. 1 and ends on May 1.

Nevada department of taxation po box 7165. Net Tax Due - Line 9 minus Line 10 and enter Net Tax Due. Nevada department of taxation po box 7165.

Comply with our easy steps to have your Nevada Modified Business Tax Form 2020 ready quickly. Taxable wages x 2 02 the tax due. The amnesty period will begin Feb.

Determine the number of days the payments is late and multiply the net tax owed by the appropriate rate based on the table below. Commerce Tax Credit - Enter 50 of the Commerce Tax paid in the prior tax year up to the amount of MBT tax owed. Choose the web sample from the catalogue.

Click the Get Form button on this page. Nevada State Commerce Tax return is due between the end of the taxable year July 1st and the due date of the Commerce tax return - August 14th. NEVADA DEPARTMENT OF TAXATION MODIFIED BUSINESS TAX RETURN Mail Original To.

NEVADA DEPARTMENT OF TAXATION MODIFIED BUSINESS TAX RETURN GENERAL BUSINESS Mail Original To. Now working with a Nevada Modified Business Tax Form 2020 requires no more than 5 minutes. Our state-specific online samples and complete recommendations eliminate human-prone faults.

Call the 24-Hour New Mexico Tax Fraud Hot Line. NEVADA DEPARTMENT OF TAXATION PO BOX 52609 PHOENIX AZ 85072-2609 TID No020-TX PERIOD ENDING. There are three ways to report tax fraud.

MODIFIED BUSINESS TAX Nevada Educational Choice Scholarship Program A taxpayer who is required to pay a Modified Business Tax MBT per NRS 363A or NRS 363B may receive a credit against the MBT tax due for any donation of money made by the taxpayer to a scholarship organization. General business effective july 1 2016 for department use only mail original to. Nevada Modified Business Tax Form Pdf.

NEVADA DEPARTMENT OF TAXATION PO BOX 52674 PHOENIX AZ 85072-2674 FOR DEPARTMENT USE ONLY LICENSE NO. The default dates for submission are April 30 July 31 October 31 and January 31. You will be forwarded to our PDF editor.

This is the standard quarterly return for reporting the Modified Business Tax for businesses who are subject to the tax on the Net Proceeds of Minerals imposed pursuant to NRS 362. IF POSTMARKED AFTER DUE DATE PENALTY AND INTEREST WILL APPLY If the address as shown is incorrect please make any. How to Edit Your Modified business tax return nevada Online Easily and Quickly.

Effective July 1 2019 the tax rate changes to 1853 from 20. The direct or indirect ownership control or possession of 50 or more of the ownership interest. Forms and payments must be mailed to the address below.

It could take as long as 15 days for your check to clear your account. What is the Nevada Modified Business Tax.

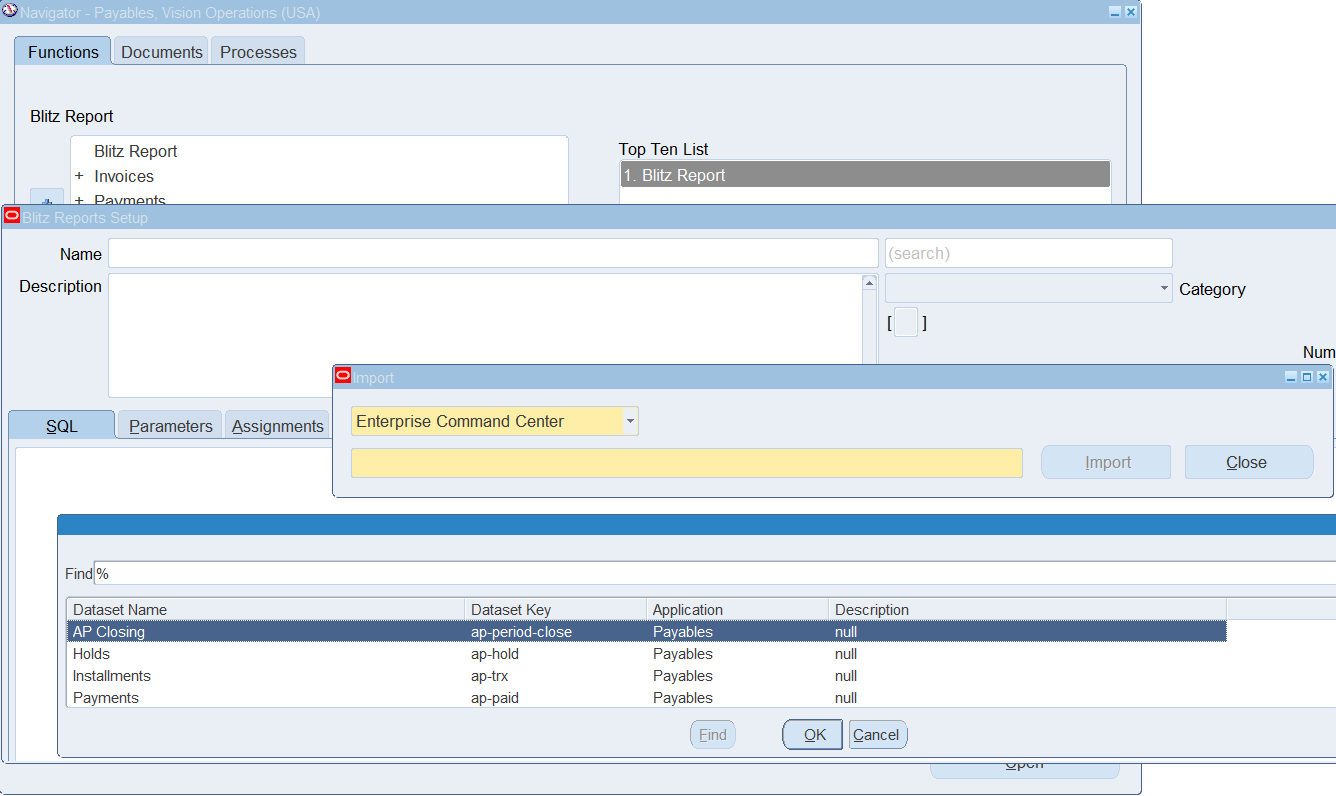

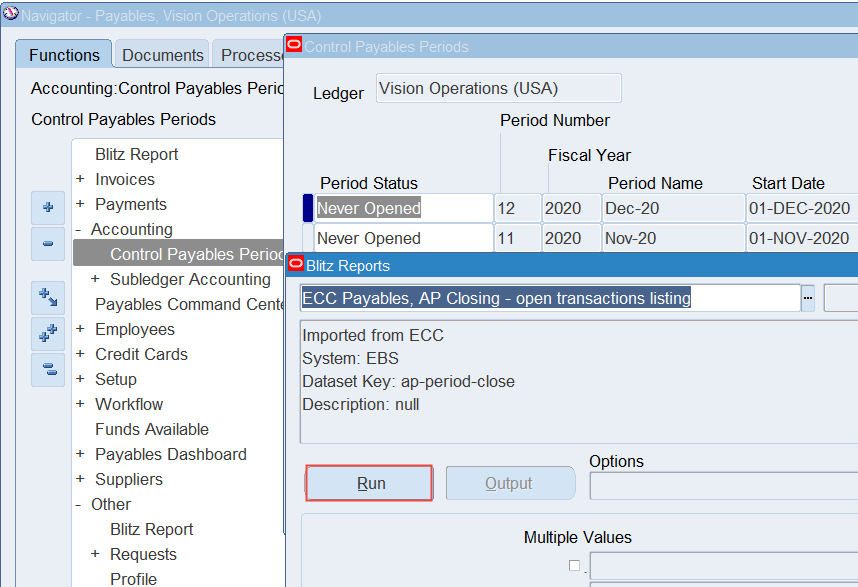

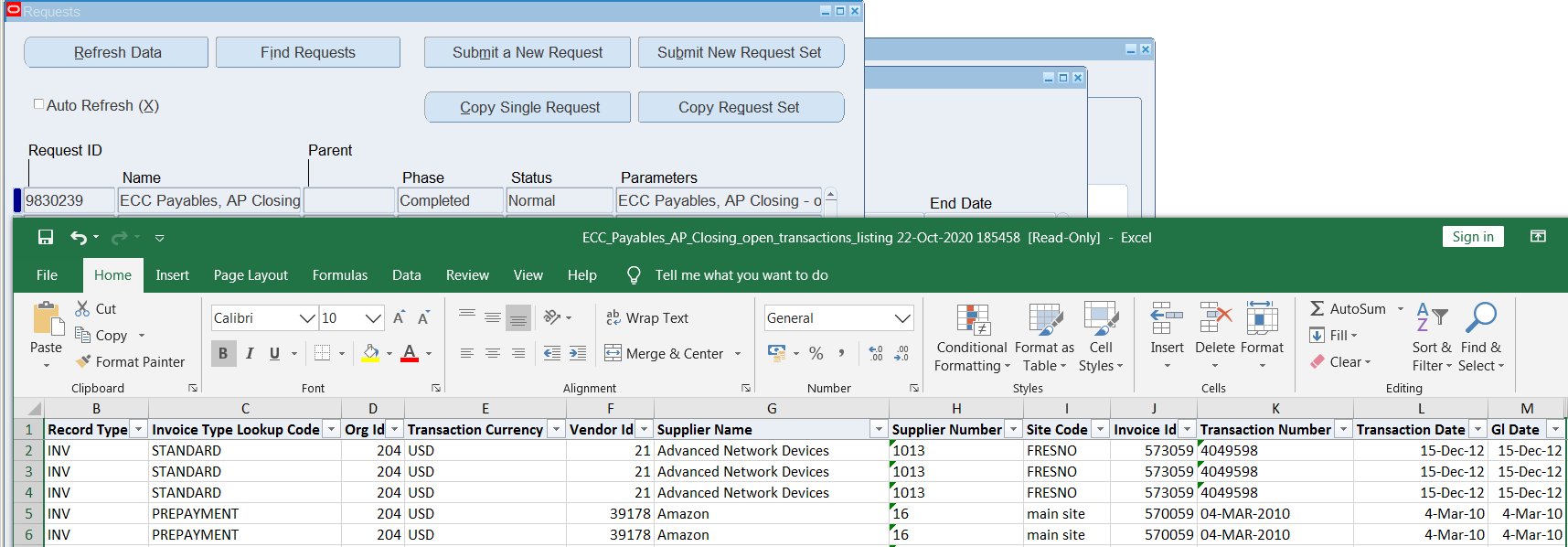

How To Develop Proven Ebs Reports Using Oracle Enterprise Command Center Sqls In Under 5 Minutes Enginatics

How To Develop Proven Ebs Reports Using Oracle Enterprise Command Center Sqls In Under 5 Minutes Enginatics

Nevada Modified Business Tax 2020 2022 Fill And Sign Printable Template Online Us Legal Forms

How To Develop Proven Ebs Reports Using Oracle Enterprise Command Center Sqls In Under 5 Minutes Enginatics

Filing Taxes After A Divorce Is Alimony Taxable Turbotax Tax Tips Videos

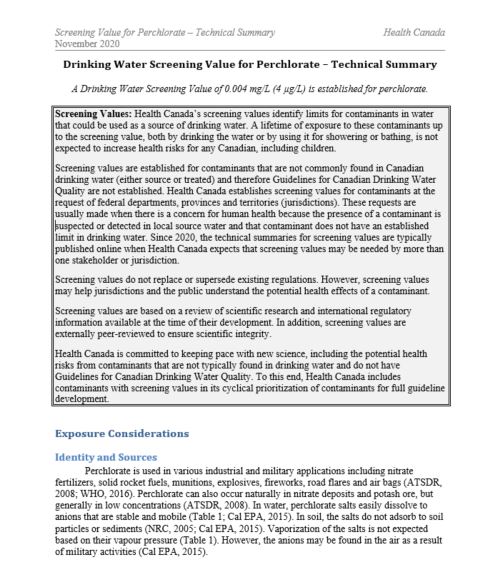

Drinking Water Screening Value For Perchlorate Technical Summary Canada Ca

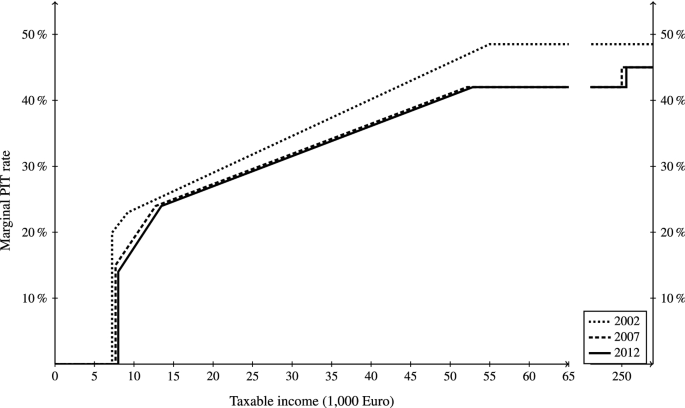

The Effects Of Income Taxation On Entrepreneurial Investment A Puzzle Springerlink

Certificate Of Designation Series C